How Does EDI Work?

Why Do I Need It for My Automotive Business?

As a technology, Electronic Data Interchange (EDI) is 50 years old – not exactly cutting edge. But the ability to exchange common business documents electronically between trading partners has never been more important. And today EDI is less costly and easier to implement than ever. Let’s look at some of the unique EDI requirements and industry-specific solutions available in the auto parts distribution industry.

What is EDI and How Does it Work?

The automotive business produces millions of transactions such as purchase orders, ship notices and invoices every day. In paper form, these documents are expensive and time-consuming to manage. Since every enterprise of any size uses computer systems to create and receive its transactions, doesn’t it make sense to exchange these messages electronically?

The core function of EDI is to take a message, such as a purchase order, from the Buyer’s computer system, and send that message to the vendor’s computer system in a form that it can understand and process. The devil is in the details. It is almost certain that the systems of the trading partners will require different communication protocols; they can potentially format their documents in unique languages and structures; and the technical specifications are certain to vary field by field (length, syntax, decimals, etc).

Given the limitless combinations and permutations of format, protocol and specification it’s a miracle that any message can be successfully understood by two business systems. Thanks to global EDI standards and industry-specific solutions and best practices, it is common for disparate technologies to exchange messages successfully. And it can be engineered to communicate with any auto parts drop shipping software.

EDI connectivity is typically done in one of two ways:

- Point-to-point – this refers to the single-use integration that is engineered between the trading partners for each new connection. This requires both parties to have EDI software and a high level of technical resources. This limits the number of connections that can be put into production in a limited amount of time. The biggest drawback is that if any facet of the connection: protocol, format, or specification, changes on the part of any trading partner, the connection fails, and errors occur. Point-to-point is, therefore, only the best choice when alternatives do not exist.

- Third-Party EDI solution providers – As the name suggests, when a solution provider is positioned between the trading partners, the connectivity is no longer to a single point, but to a network of other trading partners connected to the provider. The role of the third party is to translate, convert or map the messages from their original form to that required by the trading partner. New connections can go into production in much less time than point-to-point because each trading partner only needs to connect to the EDI service provider one time.

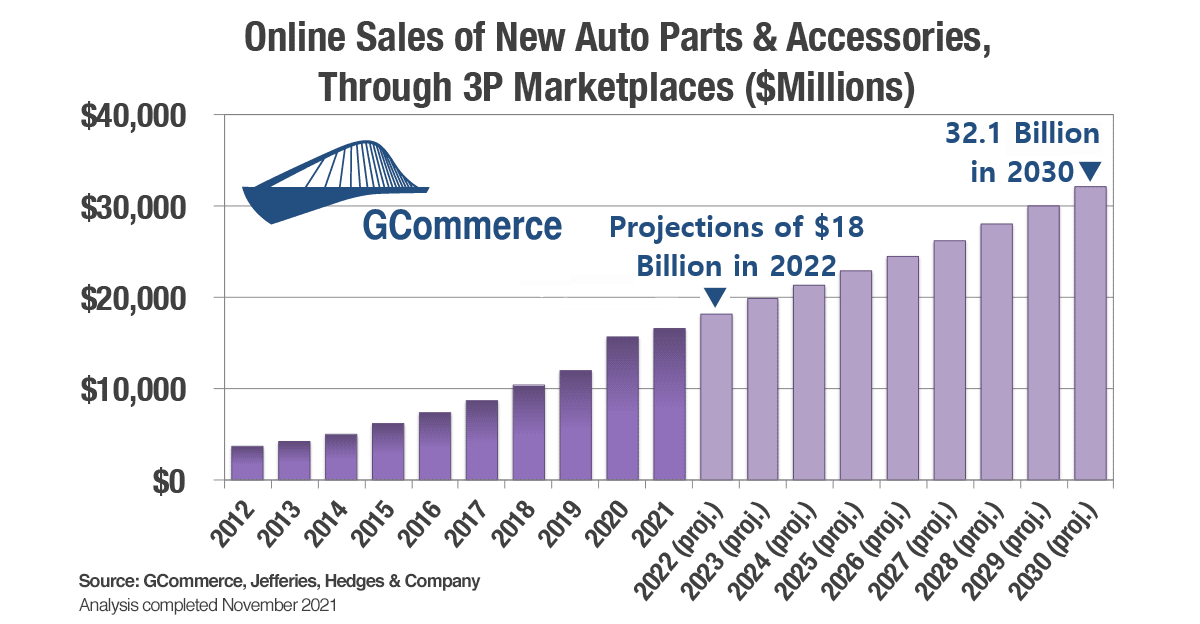

- Industry-focused Third-Party solutions: When a solution provider is focused on an industry such as auto parts and accessories, they can optimize their technology for the specific requirements of the active trading partners. For example, the field “Core Value” is important to pricing a remanufactured product but could be misunderstood in the Grocery industry. Additionally, large nationwide retailers and distributors require hundreds of trading partner connections – all with similar technical requirements and specifications. GCommerce is a third-party EDI solution provider serving the automotive aftermarket almost exclusively. A benefit of their domain expertise across several thousands of connections was to document and share an EDI Super Spec© that reflected the common practices of the trading partners they served. 80-90% of the automotive EDI requirements are reflected in the Super Spec and re-used from one connection to the next. This makes new EDI connections much faster and simpler to put into production.

What are the Benefits of EDI to Automotive Distributors and Brands?

- Electronic documents are less costly and faster to exchange than paper. EDI purchase orders get received and entered in the supplier’s business system in seconds with no manual data entry or errors. EDI Shipping Notices inform the Buyer of the parts in the shipment before the truck leaves the shipping dock. And EDI Invoices complete the procurement cycle and allow the accounts payable system to reconcile the PO and Shipment with the Invoice electronically and only report exceptions that require intervention. Staff can focus on tasks of higher value instead of pushing paper and entering data that was electronic before it got printed by the sender.

- While it may not be very sexy, savings in paper and postage costs can add up to be substantial in a high-volume enterprise.

- Business decisions and processes are only as good as the latest information about your business. When transactions are exchanged via EDI and data is presented in seconds rather than hours or days, data collection, reporting, and analytics are more actionable and valuable.

- In the auto parts distribution business, inventory availability and safety stocks are critical differentiators. The best businesses are measured with superior inventory turns and service levels. Faster order-to-sale cycles enabled by EDI ensure higher parts availability and lower the amount of safety stock required to cover for delays and uncertainty.

GCommerce is the leader in proving EDI messaging services to thousands of unique trading partner connections in the automotive, heavy-duty, specialty accessories, paint and body, and tools and equipment distribution channels. Their automotive EDI solution environment is the fastest and most reliable network in the industry.