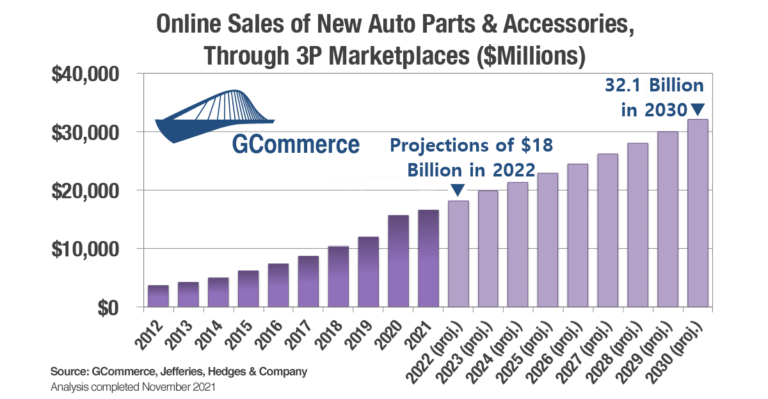

GCommerce estimates aftermarket marketplace revenue of auto parts & accessories at $16.6 billion in 2021 and projects 2022 revenue at more than $18 billion.

These numbers are part of a ground-breaking report released by the Auto Care Association and AASA at the 2021 AAPEX Show. GCommerce is proud to have been a contributor to the report.

Marketplaces are driving significant online revenue of parts & accessories

Third-party (3P) marketplaces, including Amazon, Walmart, eBay, NewEgg and others, are projected to grow to $32 billion in automotive parts & accessories revenue by 2030. This a huge jump even for these

3P marketplaces had a huge 31% year-over-year revenue increase in 2020, directly related to the pandemic. This is similar to other industries, as the pandemic shifted millions of consumers to shopping and buying online. During the pandemic many consumers either bought online for the first time or shifted more purchases from brick and mortar to online.

GCommerce is projecting the important 3P sales channel to grow at 7% to 10% per year for the foreseeable future.

Amazon is an important platform for third-party parts & accessory sales, and passed $6 billion in revenue in 2021. An estimated $3.5 billion in 3P revenue came from eBay Motors, followed by Walmart.com, estimated at $2.1 billion.

Total aftermarket online revenue at $34.7 billion in 2021

Total online parts & accessories revenue is estimated at $34.7 billion for 2021, combining 3P marketplace with first-party (1P) revenue from eCommerce retailers (the “.com” websites). Combined 1P and 3P online revenue is projected to have an 8.6% compounded annual growth rate (CAGR) through 2025.

The penetration rate of eCommerce, or the share of automotive aftermarket sales made using eCommerce as a buying channel, has doubled since 2018. The report says that it has grown from 6.5% to 12.1% in 2021. Even with that adoption rate, and even the recent dramatic growth rate, the aftermarket has a lot of room to catch up to other industries, where the eCommerce adoption rate is much higher.

Everyone now has a digital transformation playbook. What was a planning horizon of years is now months.

An important takeaway from the Auto Care Association/AASA report is the need to develop an eCommerce market strategy. The report states, “As the online channel continues to grow and take share from traditional brick & mortar participants it will become increasingly important for legacy aftermarket players to adapt their market strategy and develop an eCommerce playbook.“

The report also identifies the eCommerce channel as, “…one of the fastest growing segments of the automotive aftermarket.”

Takeaways for aftermarket companies

As we see it, there are two significant takeaways for manufacturers, distributors and marketplaces in the aftermarket.

One, if you still don’t have an effective digital transformation strategy, now is certainly the time. Even if you have one it needs to be revisited from time to time to stay on track. With the expected growth in the aftermarket auto parts marketplace channel

Two, if you need an efficient way to sell products online and gain exposure for your brand, GCommerce makes that a simple process. We can help facilitate drop shipping, EDI transmission of inventory levels, sending product data up and down the supply chain, and more. If you need a trusted partner to leverage eCommerce and 3P marketplaces, please give us a call. We’d be happy to discuss your eCommerce plans and give solid recommendations to increase your 2022 revenue.

Aftermarket eCommerce report

Auto Care Association and AASA released this new eCommerce report at the AAPEX Show on November 3, 2021. GCommerce partnered with Jefferies and Hedges & Company to produce these 3P projections as well as first-party (1P) revenue from eCommerce retailers (“.coms”). This valuable report is available to the general public as a 19-page Executive Summary, and to Auto Care Association/AASA members as a 33-page detailed report.